Why Gold Price is increasing

>> Sunday, 21 August 2011

By far this has been the most profitable asset class for investors who were already riding on the investment bus. But for new entrants I see a disaster. I see a bubble forming which will burst any day. But if at all this is a bubble is not known? Other competing causes that may also drive the gold prices up is the weakening dollar and Asian government (like China, India, Saudi Arabia, Bangladesh, Sri Lanka) buying Gold like mad. Dollar is one asset which can be manipulated. Government printing more notes often decreases the strength (purchasing power) of dollar. Hence people (investors) start accumulating a better asset than cash/ cash related assets. Gold is one of the best investment options available with investor which works as an excellent wealth hedge. Gold is a precious metal whose availability is limited. Unlike currencies people cannot print excess gold for greedy gains.

But why dollar is getting weaker?

The strength of a dollar is supported when other countries keeps US dollars as a reserve. Countries do this with expectation that they will use this dollar to effect imports (by paying in US dollars) and/or by lending the same dollar back to US at higher prices. This is common; the dollar saved in the vaults of neighboring countries maintains a demand and supply balance. If supply of dollar is more than its demand the dollar becomes weaker. When government prints too many notes the supply increases (for the same demand) and hence the dollar weakens. Ideally what government should be doing is to first create a demand and then print notes. This demand shall have a characteristic of adding value to the buyer. What I mean to say is that US economy has grown to such heights only because in the past they had legendry entrepreneur’s who innovated such valuable products which added great value to the whole world. But now US is more focusing on spending on Defense Machineries which actually add little value for the masses. Moreover except few geniuses still left in the country, all others have forgotten the theory of innovation required to make profits in business. So when we say that dollar is getting weaker because of printing of notes is not a complete statement. The dollar is getting weaker also because of wrong government spending (focused on wars and defense) instead of infrastructure, energy, exports, research and development, and above all increasing their competitiveness. The Asian market has quality and cheap labor in abundance. The over heads of operating is unit in US almost double than in any Asia countries. This is the reason why all companies are opening units in Asia and fleeing US. This has also contributed to US government’s dependency on printing money, as they do not have to buy ‘muscle power’ of extracting money form the reserves of Asia countries. When I say muscle power I do not means another war, I means increasing demand for US products & services by energy, exports, research and development and increasing competitiveness.

Conclusion

So investors are speculating that Gold prices will go up further. I do not have a doubt that gold prices will go up but we must also remember that the main factor contributing to this gold rush is weakening US dollars and mad rush in Asian market to buy gold. No way is US government going to allow dollar to weaken further and buying of gold will stop some day. So I would like to warn those people who are riding fast on this mad gold terrain this is eventually going to stop. It will be like a stock market crash and gold price is bound to fall. Stop speculating on gold and think innovative. Create a product that adds value to the population and mother earth. Innovation is like a small heart inside which keeps the money circulating in the economy. Be Innovative and stop your run for easy money.

Safety-seeking investors are pouring money into gold despite prices that, though lower recently, remain near historic highs. The more we worry, the higher gold will go.

By Tim Middleton

MSN Money

There are lots of good reasons to take a stake in gold, and right now the price is one of them.

After topping $1,000 an ounce in mid-February, the price of gold bullion had tumbled to $940 Monday. That's very close to a band of technical support at $935. Yet another layer at $900 should keep it from falling much lower.

Despite the lull, these are all relatively high prices historically. Yet as we face the threat of substantial global inflation as a result of recession fighting, gold's upside is enormous.

Adam Strauss, a co-manager of Appleseed Fund (APPLX), a diversified fund with a significant stake in gold, says all the steps governments are taking to fight the downturn will lead to inflation. "In fact, if you think of the ultimate way out of the housing mess, it is to devalue the dollar to get housing prices up again," he says.

Strauss is no gold bug or hard-money zealot; his fund bills itself as "socially responsible," and he says he favors investments "that allow shareholders to sleep well at night." Gold fills that bill. Appleseed bought its stake because its managers believed "gold was undervalued, and we still do, which is why we continue to own it," Strauss says.

A weakened dollar is gold's best friend. Assuming the price doesn't fall significantly below $900, "then we will start heading up again, and if we can get firmly above $1,000, I think we could run anywhere between $1,200 and $1,500" an ounce, says Mark Arbeter, the chief technical strategist for Standard & Poor's.

"Of course, some of this has to do with the action of the stock market," he adds. "The weaker the stock market is, the better gold will perform."

Rising Gold Prices will help the Economy

Jason Hommel

It is a common myth that says a rising gold price would be followed by economic doom, misery, hard times, and perhaps a dreaded depression.Jason Hommel

Nothing could be further from the truth. Rising gold and silver prices helps the economy, as I will prove.

The reason this myth is created in the media is to scare people away from investing in gold and silver. The myth creates a sense of guilt among those who own gold, and among those who are thinking about buying gold. It wrongly claims, "You will be to blame for harming the economy, if you buy gold and the gold price goes up." It whispers the socialist lie, "If we all remain in the dollar, everything will be OK."

The amazing thing about this media-myth is how many gold investors are scared out of their minds of the thought of gold rising past $3000/oz. as they fear it will bring on the prophesied economic doom, with riots, joblessness, homelessness, and widespread poverty.

Here is the reality from history. In 1933 U.S. farmers were dumping milk and destroying their crops because prices were artificially kept so low that they were losing money. Why were prices too low? Because gold was fixed at $20/oz.! And thus, other commodities were also priced too low! It would cost farmers money to bring their produce to market; therefore, they stopped doing so. The farmers were smart enough to realize and act on the axiom, "Do not engage in uneconomical activity."

I wish the silver miners today would be so smart. In other words, if you are not making a profit by mining and selling silver, stop bringing silver to market!

In my opinion Franklin D. Roosevelt was one of the worst presidents in our nation's history. He did more to befriend the big banks, and hurt the interests of the common man, and destroy economic freedom than perhaps any other president. Under FDR we got the dreaded Ponzi-scheme called Social Security. He created bigger government, social handouts, price controls, pulled the nation into World War II, and did everything needed to lead to the totalitarian government we have today.

But there was one thing he did that I think that had positive benefits. He revalued the gold price upwards from $20/oz. to $35/oz. Most gold commentators will say this was theft, a default, and the worst thing he did. But FDR did not create the theft that was originally created when excess paper money was created in the first place. The money-creation was the theft. FDR issued the decree that said that this excessively created paper money should not be valued as highly as it claimed it should be. That was the good thing FDR did, since he helped to reveal the fraud inherent in the dollar. Unfortunately, this re-valuation in the price was accompanied by the proclamation that made it illegal to own gold domestically. Yet, it still helped things for FDR to reveal the fraud of the dollar.

This created a boom in all commodity prices, and helped the farmers out tremendously, and helped the economy. Finally, it would be economic to produce food again. The rising gold price helped the economy.

If anything, the gold price did not rise high enough.

Move forward to the 1970's and 1980's. The years of Ronald Reagan, 1980 to 1988 were prosperous years. Society embraced morality more strongly than in the swinging 70's. Disco was out, and polo shirts were in. Reagan got re-elected in 1984 by asking the simple question, "Are you better off now than you were four years ago?" Prosperity followed after the gold price rose to $850 in 1980. It was not chaos, not doom, not poverty everywhere you looked. It was a boom time. The after effect of the rise in the gold price was prosperity.

So, as if the facts from history are not enough, let's look at the logical, rational reasons why higher precious metal prices will help the economy. It's very simple.

Barter is inefficient. You cannot efficiently trade cookies for a TV set, and you cannot efficiently trade a car for crayons, you cannot efficiently trade chickens for clothes. I hope I'm not boring you to tears, but do you get the concept? You cannot have an efficient economy without real money. You need a medium of exchange that is easily divisible, portable, valuable, and does not spoil or go out of style.

Gold and silver are what you need, for the reason that they make trade easier and more efficient, or economical. Gold and silver thus save time and energy, and are extremely useful.

Furthermore, a gold or silver coin cannot be tracked, does not need to be kept in a bank, does not need to pay interest, and therefore, cannot be taxed on every transaction. Therefore, gold and silver are very efficient for trading, far more efficient and useful than paper money.

(The reason that gold and silver do not need to pay interest is that there is a constant deflation when gold and silver are used as money. They grow ever more valuable over time as production grows more efficient and prosperity increase when gold and silver are used as money. This fact utterly refutes the "time value" of money that states that money today is more useful than money tomorrow, which is a lie used to justify charging interest on a loan. A no-interest gold loan, when gold is used as money, is generally repaid with gold and silver that is more valuable than before!)

In contrast to the usefulness of gold and silver as money: If I'm paid in paper money, drawn from a bank, the other party feels a compulsive need to report to the government how much he paid me, in order to keep his paper trail of transactions open for the government to follow. Thus, each transaction is looked at by the government, and is taxed at every step. This taxation harms and discourages economic activity from taking place, and thus is not an efficient process at all, and reduces trade and the exchange of dollars, and hurts the economy.

Furthermore, as paper money always suffers from inflation or hyperinflation, there is a lack of incentive to save and invest, which also hurts future production, and hurts the economy.

Next, the excessive creation of paper money and overvaluation of that paper money creates economic mis-allocations of capital, and dislocations of economic activity. Jobs are lost as workers overseas produce more for less. People over-invest in housing due to the easy money available for home loans.

Price fixing, (especially in the form of a low gold price, or a manipulated low gold price), in all its forms, hurts the economy. Price fixing is a disruption of free market capitalism. Free market capitalism, and free market prices, create the most prosperity for the most participants far more than any other economic system yet invented by man.

When the price of gold is allowed to seek its natural free market level, and when the fraud of paper money is destroyed (and paper debts wiped out), then economic freedom and prosperity will follow. It will be too expensive to wage needless wars, too expensive for a massive totalitarian government, too expensive for social programs that destroy a person's incentive to work.

When gold and silver are used as money, there will be plenty of people available to work, needing to work, and willing to work. There will be plenty of money (since the gold and silver would then be valuable enough to do the work of money). There will be plenty produced, since the economy will be free from debt, free from over-burdensome government regulations, free from excessive taxation. There will be plenty produced and prosperity will follow because gold and silver are more efficient at promoting trade than the fraud of the dollar that is over-valued and excessively-taxed.

Some people will counter with the lie that certainly paper money is lighter, and thus more efficient. Again, not true. I have a 1/10 oz. gold coin that is very light and small, lighter than a stack of $1 bills. I have a 1 oz. gold coin that is lighter and more compact than four stacks of a 100 count, $1 bills. Besides, our coins have become dross, worthless heavy slugs.

I'd rather have a tenth oz. gold coin in my wallet than two twenty-dollar bills. And I'd rather have an oz. of gold than four hundreds. Who really needs to carry around more than an ounce of gold, anyway? (Only for the large and more rare transactions.) Too heavy? Hogwash! Society can pay for the cost to transport bottled water, but transporting gold costs too much? Ridiculous!

Gold and silver are not too heavy to transport. Silver alone may be relatively heavy today, given that it is so undervalued, but when the metal is fairly valued, transportation is not a problem. When an ounce of gold or silver is $100,000/oz., then an oz. of gold or silver will not be "too heavy" to transport. Transportation costs are miniscule to the extreme, and are no justification for the fraud of paper money.

If gold and silver are good for an economy, the parallel point is that fraud is bad for an economy. And since the dollar is fraud, then the dollar is bad for the economy. Yes, it's that simple.

A rising gold price means economic misery for the Federal Reserve, for politicians, for the banks, and for the socialists, and all whom they sponsor, such as the Universities and mass media. A rising gold price means economic freedom and prosperity to everyone else!

Buying gold and silver will bring prosperity not only to you, but also to everyone else! Buying gold and silver is the most useful and economic thing you can do to help bring a positive change to the corruption of society that exists at all levels.

If you would like to learn more about gold and money, please come by and visit goldismoney.com. I also write a free weekly silver stocks report that lists over 80 different silver stocks, and you can sign up to receive it at www.goldismoney.com.

December 2, 2003Gold (

Gold resists attacks by individual acids, but it can be dissolved by the aqua regia (nitro-hydrochloric acid), so named because it dissolves gold. Gold also dissolves in alkaline solutions of cyanide, which have been used in mining. Gold dissolves in mercury, forming amalgam alloys. Gold is insoluble in nitric acid, which dissolves silver and base metals, a property that has long been used to confirm the presence of gold in items, giving rise to the term the acid test.

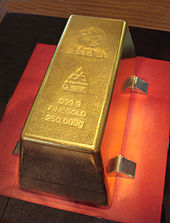

Gold has been a valuable and highly sought-after precious metal for coinage, jewelry, and other arts since long before the beginning of recorded history.Gold standards have been the most common basis for monetary policies throughout human history, being widely supplanted by fiat currency only in the late 20th century. Gold has also been frequently linked to a wide variety of symbolisms and ideologies. A total of 165,000 tonnes of gold have been mined in human history, as of 2009.[1] This is roughly equivalent to 5.3 billion troy ounces or, in terms of volume, about 8500 m3, or a cube 20.4 m on a side. The world consumption of new gold produced is about 50% in jewelry, 40% in investments, and 10% in industry.[2]

Besides its widespread monetary and symbolic functions, gold has many practical uses in dentistry, electronics, and other fields. Its high malleability,ductility, resistance to corrosion and most other chemical reactions, and conductivity of electricity lead to many uses of gold, including electric wiring, colored glass production and even gold leaf eating.

Characteristics

Gold is the most malleable and ductile of all metals; a single gram can be beaten into a sheet of 1 square meter, or an ounce into 300 square feet. Gold leaf can be beaten thin enough to become translucent. The transmitted light appears greenish blue, because gold strongly reflects yellow and red.[3] Such semi-transparent sheets also strongly reflect infrared light, making them useful as infrared (radiant heat) shields in visors of heat-resistant suits, and in sun-visors for spacesuits.[4]

Gold readily creates alloys with many other metals. These alloys can be produced to modify the hardness and other metallurgical properties, to controlmelting point or to create exotic colors (see below).[5] Gold is a good conductor of heat and electricity and reflects infrared radiation strongly. Chemically, it is unaffected by air, moisture and most corrosive reagents, and is therefore well suited for use in coins and jewelry and as a protective coating on other, more reactive, metals. However, it is not chemically inert.

Common oxidation states of gold include +1 (gold(I) or aurous compounds) and +3 (gold(III) or auric compounds). Gold ions in solution are readily reducedand precipitated out as gold metal by adding any other metal as the reducing agent. The added metal is oxidized and dissolves allowing the gold to be displaced from solution and be recovered as a solid precipitate.

High quality pure metallic gold is tasteless and scentless, in keeping with its resistance to corrosion (it is metal ions which confer taste to metals).[6]

In addition, gold is very dense, a cubic meter weighing 19,300 kg. By comparison, the density of lead is 11,340 kg/m3, and that of the densest element,osmium, is 22,610 kg/m3.

Color

Whereas most other pure metals are gray or silvery white, gold is yellow. This color is determined by the density of loosely bound (valence) electrons; those electrons oscillate as a collective "plasma" medium described in terms of a quasiparticle called plasmon. The frequency of these oscillations lies in the ultraviolet range for most metals, but it falls into the visible range for gold due to subtle relativistic effects that affect theorbitals around gold atoms.[7][8] Similar effects impart a golden hue to metallic cesium (see relativistic quantum chemistry).

Common colored gold alloys such as rose gold can be created by the addition of various amounts of copper and silver, as indicated in the triangular diagram to the left. Alloys containing palladium or nickel are also important in commercial jewelry as these produce white gold alloys. Less commonly, addition of manganese,aluminium, iron, indium and other elements can produce more unusual colors of gold for various applications.[5]

Isotopes

Main article: Isotopes of gold

Gold has only one stable isotope, 197Au, which is also its only naturally occurring isotope. Thirty-six radioisotopes have been synthesized ranging inatomic mass from 169 to 205. The most stable of these is 195Au with a half-life of 186.1 days. The least stable is 171Au, which decays by proton emissionwith a half-life of 30 µs. Most of gold's radioisotopes with atomic masses below 197 decay by some combination of proton emission, α decay, and β+ decay. The exceptions are 195Au, which decays by electron capture, and 196Au, which decays most often by electron capture (93%) with a minor β- decay path (7%).[9] All of gold's radioisotopes with atomic masses above 197 decay by β- decay.[10]

At least 32 nuclear isomers have also been characterized, ranging in atomic mass from 170 to 200. Within that range, only 178Au, 180Au, 181Au, 182Au, and 188Au do not have isomers. Gold's most stable isomer is 198m2Au with a half-life of 2.27 days. Gold's least stable isomer is 177 m2Au with a half-life of only 7 ns. 184 m1Au has three decay paths: β+ decay, isomeric transition, and alpha decay. No other isomer or isotope of gold has three decay paths.[10]

Use and applications

Monetary exchange

Gold has been widely used throughout the world as a vehicle for monetary exchange, either by issuance and recognition of gold coins or other bare metal quantities, or through gold-convertible paper instruments by establishing gold standards in which the total value of issued money is represented in a store of gold reserves.

However, production has not grown in relation to the world's economies. Today, gold mining output is declining.[11] With the sharp growth of economies in the 20th century, and increasing foreign exchange, the world's gold reserves and their trading market have become a small fraction of all markets and fixed exchange rates of currencies to gold were no longer sustained. At the beginning ofWorld War I the warring nations moved to a fractional gold standard, inflating their currencies to finance the war effort. After World War II gold was replaced by a system of convertible currency following the Bretton Woods system. Gold standards and the direct convertibility of currencies to gold have been abandoned by world governments, being replaced by fiat currency in their stead. Switzerland was the last country to tie its currency to gold; it backed 40% of its value until the Swiss joined the International Monetary Fund in 1999.[12]

Pure gold is too soft for day-to-day monetary use and is typically hardened by alloying with copper, silver or other base metals. The gold content of alloys is measured in carats (k). Pure gold is designated as 24k. English gold coins intended for circulation from 1526 into the 1930s were typically a standard 22k alloy called crown gold, for hardness (American gold coins for circulation after 1837 contained the slightly lower amount of 0.900 fine gold, or 21.6 kt).

Investment

Main article: Gold as an investment

Many holders of gold store it in form of bullion coins or bars as a hedge against inflation or other economic disruptions. However, some economists do not believe gold serves as a hedge against inflation or currency depreciation.[13]

The ISO 4217 currency code of gold is XAU.

Modern bullion coins for investment or collector purposes do not require good mechanical wear properties; they are typically fine gold at 24k, although the American Gold Eagle, the British gold sovereign, and the South African Krugerrand continue to be minted in 22k metal in historical tradition. The special issue Canadian Gold Maple Leaf coin contains the highest purity gold of any bullion coin, at 99.999% or 0.99999, while the popular issue Canadian Gold Maple Leaf coin has a purity of 99.99%. Several other 99.99% pure gold coins are available. In 2006, the United States Mint began production of the American Buffalo gold bullion coin with a purity of 99.99%. The Australian Gold Kangaroos were first coined in 1986 as the Australian Gold Nugget but changed the reverse design in 1989. Other popular modern coins include the Austrian Vienna Philharmonic bullion coin and the Chinese Gold Panda.

Jewelry

Main article: Jewellery

Because of the softness of pure (24k) gold, it is usually alloyed with base metals for use in jewelry, altering its hardness and ductility, melting point, color and other properties. Alloys with lower caratage, typically 22k, 18k, 14k or 10k, contain higher percentages of copper, or other base metals or silver or palladium in the alloy. Copper is the most commonly used base metal, yielding a redder color. Eighteen-carat gold containing 25% copper is found in antique and Russian jewelry and has a distinct, though not dominant, copper cast, creating rose gold. Fourteen-carat gold-copper alloy is nearly identical in color to certain bronze alloys, and both may be used to produce police and other badges. Blue gold can be made by alloying with iron and purple gold can be made by alloying with aluminium, although rarely done except in specialized jewelry. Blue gold is more brittle and therefore more difficult to work with when making jewelry. Fourteen and eighteen carat gold alloys with silver alone appear greenish-yellow and are referred to as green gold. White gold alloys can be made with palladium or nickel. White 18-carat gold containing 17.3% nickel, 5.5% zinc and 2.2% copper is silvery in appearance. Nickel is toxic, however, and its release from nickel white gold is controlled by legislation in Europe. Alternative white gold alloys are available based on palladium, silver and other white metals,[14] but the palladium alloys are more expensive than those using nickel. High-carat white gold alloys are far more resistant to corrosion than are either pure silver or sterling silver. The Japanese craft of Mokume-gane exploits the color contrasts between laminated colored gold alloys to produce decorative wood-grain effects.

Medicine

In medieval times, gold was often seen as beneficial for the health, in the belief that something that rare and beautiful could not be anything but healthy. Even some modern esotericists and forms ofalternative medicine assign metallic gold a healing power.[15] Some gold salts do have anti-inflammatory properties and are used as pharmaceuticals in the treatment of arthritis and other similar conditions.[16] However, only salts and radioisotopes of gold are of pharmacological value, as elemental (metallic) gold is inert to all chemicals it encounters inside the body. In modern times, injectable gold has been proven to help to reduce the pain and swelling of rheumatoid arthritis and tuberculosis.[16][17]

Gold alloys are used in restorative dentistry, especially in tooth restorations, such as crowns and permanent bridges. The gold alloys' slight malleability facilitates the creation of a superior molar mating surface with other teeth and produces results that are generally more satisfactory than those produced by the creation of porcelain crowns. The use of gold crowns in more prominent teeth such as incisors is favored in some cultures and discouraged in others.

Colloidal gold preparations (suspensions of gold nanoparticles) in water are intensely red-colored, and can be made with tightly controlled particle sizes up to a few tens of nanometers across by reduction of gold chloride with citrate or ascorbate ions. Colloidal gold is used in research applications in medicine, biology and materials science. The technique of immunogold labeling exploits the ability of the gold particles to adsorb protein molecules onto their surfaces. Colloidal gold particles coated with specific antibodies can be used as probes for the presence and position of antigens on the surfaces of cells.[18] In ultrathin sections of tissues viewed by electron microscopy, the immunogold labels appear as extremely dense round spots at the position of the antigen.[19] Colloidal gold is also the form of gold used as gold paint on ceramics prior to firing.

Gold, or alloys of gold and palladium, are applied as conductive coating to biological specimens and other non-conducting materials such as plastics and glass to be viewed in a scanning electron microscope. The coating, which is usually applied by sputtering with an argon plasma, has a triple role in this application. Gold's very high electrical conductivity drains electrical charge to earth, and its very high density provides stopping power for electrons in the electron beam, helping to limit the depth to which the electron beam penetrates the specimen. This improves definition of the position and topography of the specimen surface and increases the spatial resolution of the image. Gold also produces a high output of secondary electrons when irradiated by an electron beam, and these low-energy electrons are the most commonly used signal source used in the scanning electron microscope.[20]

The isotope gold-198, (half-life 2.7 days) is used in some cancer treatments and for treating other diseases.[21]

Food and drink

- Gold can be used in food and has the E number 175.[22]

- Gold leaf, flake or dust is used on and in some gourmet foods, notably sweets and drinks as decorative ingredient.[23] Gold flake was used by the nobility in Medieval Europe as a decoration in food and drinks, in the form of leaf, flakes or dust, either to demonstrate the host's wealth or in the belief that something that valuable and rare must be beneficial for one's health.

- Danziger Goldwasser (German: Gold water of Danzig) or Goldwasser (English: Goldwater) is a traditional German herbal liqueur[24] produced in what is today Gdańsk, Poland, and Schwabach, Germany, and contains flakes of gold leaf. There are also some expensive (~$1000) cocktails which contain flakes of gold leaf.[25] However, since metallic gold is inert to all body chemistry, it has no taste, it provides no nutrition, and it leaves the body unaltered.[26]

Industry

- Gold solder is used for joining the components of gold jewelry by high-temperature hard soldering or brazing. If the work is to be of hallmarking quality, gold solder must match the carat weight of the work, and alloy formulas are manufactured in most industry-standard carat weights to color match yellow and white gold. Gold solder is usually made in at least three melting-point ranges referred to as Easy, Medium and Hard. By using the hard, high-melting point solder first, followed by solders with progressively lower melting points, goldsmiths can assemble complex items with several separate soldered joints.

- Gold can be made into thread and used in embroidery.

- Gold produces a deep, intense red color when used as a coloring agent in cranberry glass.

- In photography, gold toners are used to shift the color of silver bromide black-and-white prints towards brown or blue tones, or to increase their stability. Used on sepia-toned prints, gold toners produce red tones. Kodak published formulas for several types of gold toners, which use gold as the chloride.[27]

- As gold is a good reflector of electromagnetic radiation such as infrared and visible light as well as radio waves, it is used for the protective coatings on many artificial satellites, in infrared protective faceplates in thermal protection suits and astronauts' helmets and in electronic warfare planes like the EA-6B Prowler.

- Gold is used as the reflective layer on some high-end CDs.

- Automobiles may use gold for heat dissipation. McLaren uses gold foil in the engine compartment of its F1 model.[28]

- Gold can be manufactured so thin that it appears transparent. It is used in some aircraft cockpit windows for de-icing or anti-icing by passing electricity through it. The heat produced by the resistance of the gold is enough to deter ice from forming.[29]

Electronics

The concentration of free electrons in gold metal is 5.90×1022 cm−3. Gold is highly conductive to electricity, and has been used for electrical wiring in some high-energy applications (only silver and copper are more conductive per volume, but gold has the advantage of corrosion resistance). For example, gold electrical wires were used during some of the Manhattan Project's atomic experiments, but large high current silver wires were used in the calutron isotope separator magnets in the project.

Though gold is attacked by free chlorine, its good conductivity and general resistance to oxidation and corrosion in other environments (including resistance to non-chlorinated acids) has led to its widespread industrial use in the electronic era as a thin layer coating electrical connectors of all kinds, thereby ensuring good connection. For example, gold is used in the connectors of the more expensive electronics cables, such as audio, video and USB cables. The benefit of using gold over other connector metals such as tin in these applications is highly debated. Gold connectors are often criticized by audio-visual experts as unnecessary for most consumers and seen as simply a marketing ploy. However, the use of gold in other applications in electronic sliding contacts in highly humid or corrosive atmospheres, and in use for contacts with a very high failure cost (certain computers, communications equipment, spacecraft, jet aircraft engines) remains very common.[30]

Besides sliding electrical contacts, gold is also used in electrical contacts because of its resistance to corrosion, electrical conductivity, ductility and lack oftoxicity.[31] Switch contacts are generally subjected to more intense corrosion stress than are sliding contacts. Fine gold wires are used to connect semiconductor devices to their packages through a process known as wire bonding.

Commercial chemistry

Gold is attacked by and dissolves in alkaline solutions of potassium or sodium cyanide, to form the salt gold cyanide—a technique that has been used in extracting metallic gold from ores in the cyanide process. Gold cyanide is the electrolyte used in commercial electroplating of gold onto base metals and electroforming.

Gold chloride (chloroauric acid) solutions are used to make colloidal gold by reduction with citrate or ascorbate ions. Gold chloride and gold oxide are used to make highly valued cranberry or red-colored glass, which, like colloidal gold suspensions, contains evenly sized spherical gold nanoparticles.[32]

History

Gold has been known and used by artisans since the Chalcolithic. Gold artifacts in the Balkans appear from the 4th millennium BC, such as that found in the Varna Necropolis. Gold artifacts such as the golden hats and the Nebra disk appeared in Central Europe from the 2nd millennium BC Bronze Age.

Egyptian hieroglyphs from as early as 2600 BC describe gold, which king Tushratta of the Mitanni claimed was "more plentiful than dirt" in Egypt.[33] Egypt and especially Nubia had the resources to make them major gold-producing areas for much of history. The earliest known map is known as the Turin Papyrus Map and shows the plan of a gold mine in Nubia together with indications of the local geology. The primitive working methods are described by both Strabo and Diodorus Siculus, and included fire-setting. Large mines were also present across the Red Sea in what is now Saudi Arabia.

The legend of the golden fleece may refer to the use of fleeces to trap gold dust from placer deposits in the ancient world. Gold is mentioned frequently in theOld Testament, starting with Genesis 2:11 (at Havilah) and is included with the gifts of the magi in the first chapters of Matthew New Testament. The Book of Revelation 21:21 describes the city of New Jerusalem as having streets "made of pure gold, clear as crystal". The south-east corner of the Black Sea was famed for its gold. Exploitation is said to date from the time of Midas, and this gold was important in the establishment of what is probably the world's earliest coinage in Lydia around 610 BC.[34] From the 6th or 5th century BC, the Chu (state) circulated the Ying Yuan, one kind of square gold coin.

In Roman metallurgy, new methods for extracting gold on a large scale were developed by introducing hydraulic mining methods, especially in Hispania from 25 BC onwards and in Dacia from 106 AD onwards. One of their largest mines was at Las Medulas in León (Spain), where seven long aqueducts enabled them to sluice most of a large alluvial deposit. The mines at Roşia Montană in Transylvania were also very large, and until very recently, still mined by opencast methods. They also exploited smaller deposits in Britain, such as placer and hard-rock deposits at Dolaucothi. The various methods they used are well described by Pliny the Elder in his encyclopedia Naturalis Historia written towards the end of the first century AD.

The Mali Empire in Africa was famed throughout the old world for its large amounts of gold. Mansa Musa, ruler of the empire (1312–1337) became famous throughout the old world for his great hajj to Mecca in 1324. When he passed through Cairo in July 1324, he was reportedly accompanied by a camel train that included thousands of people and nearly a hundred camels. He gave away so much gold that it depressed the price in Egypt for over a decade.[35] A contemporary Arab historian remarked:

Gold was at a high price in Egypt until they came in that year. The mithqal did not go below 25 dirhams and was generally above, but from that time its value fell and it cheapened in price and has remained cheap till now. The mithqal does not exceed 22 dirhams or less. This has been the state of affairs for about twelve years until this day by reason of the large amount of gold which they brought into Egypt and spent there [...]

The European exploration of the Americas was fueled in no small part by reports of the gold ornaments displayed in great profusion by Native American peoples, especially in Central America, Peru, Ecuador and Colombia. The Aztecs regarded gold as literally the product of the gods, calling it "god excrement" (teocuitlatl inNahuatl).[37] However, for the indigenous peoples of North America, gold was considered useless, and they saw much greater value in other minerals, which were directly related to their utility, such as obsidian, flint, and slate.[38]

Although the price of some platinum group metals can be much higher, gold has long been considered the most desirable of precious metals, and its value has been used as the standard for many currencies (known as the gold standard) in history. Gold has been used as a symbol for purity, value, royalty, and particularly roles that combine these properties. Gold as a sign of wealth and prestige was ridiculed by Thomas More in his treatise Utopia. On that imaginary island, gold is so abundant that it is used to make chains for slaves, tableware and lavatory-seats. When ambassadors from other countries arrive, dressed in ostentatious gold jewels and badges, the Utopians mistake them for menial servants, paying homage instead to the most modestly dressed of their party.

There is an age-old tradition of biting gold to test its authenticity. Although this is certainly not a professional way of examining gold, the bite test should score the gold because gold is a soft metal, as indicated by its score on the Mohs' scale of mineral hardness. The purer the gold the easier it should be to mark it. Painted lead can cheat this test because lead is softer than gold (and may invite a small risk of lead poisoning if sufficient lead is absorbed by the biting).

Gold in antiquity was relatively easy to obtain geologically; however, 75% of all gold ever produced has been extracted since 1910.[39] It has been estimated that all gold ever refined would form a single cube 20 m (66 ft) on a side (equivalent to 8,000 m3).[39]

One main goal of the alchemists was to produce gold from other substances, such as lead — presumably by the interaction with a mythical substance called thephilosopher's stone. Although they never succeeded in this attempt, the alchemists promoted an interest in what can be done with substances, and this laid a foundation for today's chemistry. Their symbol for gold was the circle with a point at its center (☉), which was also the astrological symbol and the ancient Chinese character for the Sun. For modern creation of artificial gold by neutron capture, see gold synthesis.

During the 19th century, gold rushes occurred whenever large gold deposits were discovered. The first documented discovery of gold in the United States was at the Reed Gold Mine near Georgeville, North Carolina in 1803.[40] The first major gold strike in the United States occurred in a small north Georgia town called Dahlonega.[41] Further gold rushes occurred in California, Colorado, the Black Hills, Otago in New Zealand, Australia, Witwatersrand in South Africa, and the Klondike in Canada.

Because of its historically high value, much of the gold mined throughout history is still in circulation in one form or another.

Occurrence

Gold's atomic number of 79 makes it one of the higher atomic number elements which occur naturally. Like all elements with atomic numbers larger than iron, gold is thought to have been formed from a supernova nucleosynthesis process. Their explosions scattered metal-containing dusts (including heavy elementslike gold) into the region of space in which they later condensed into our solar system and the Earth.[42]

On Earth, whenever elemental gold occurs, it appears most often as a metal solid solution of gold with silver, i.e. a gold silver alloy. Such alloys usually have a silver content of 8–10%. Electrum is elemental gold with more than 20% silver. Electrum's color runs from golden-silvery to silvery, dependent upon the silver content. The more silver, the lower the specific gravity.

Gold is found in ores made up of rock with very small or microscopic particles of gold. This gold ore is often found together with quartz or sulfide mineralssuch as Fool's Gold, which is a pyrite.[43] These are called lode deposits. Native gold is also found in the form of free flakes, grains or larger nuggets that have been eroded from rocks and end up in alluvial deposits (called placer deposits). Such free gold is always richer at the surface of gold-bearing veins owing to the oxidation of accompanying minerals followed by weathering, and washing of the dust into streams and rivers, where it collects and can be welded by water action to form nuggets.

Gold sometimes occurs combined with tellurium as the minerals calaverite, krennerite, nagyagite, petzite and sylvanite, and as the rare bismuthide maldonite(Au2Bi) and antimonide aurostibite (AuSb2). Gold also occurs in rare alloys with copper, lead, and mercury: the minerals auricupride (Cu3Au), novodneprite (AuPb3) and weishanite ((Au, Ag)3Hg2).

Recent research suggests that microbes can sometimes play an important role in forming gold deposits, transporting and precipitating gold to form grains and nuggets that collect in alluvial deposits.[44]

The world's oceans contain gold. Measured concentrations of gold in the Atlantic and Northeast Pacific are 50–150 fmol/L or 10–30 parts per quadrillion (about 10–30 g/km3). In general, Au concentrations for Atlantic and Pacific samples are the same (~50 fmol/L) but less certain. Mediterranean deep waters contain higher concentrations of Au (100–150 fmol/L) attributed to wind-blown dust and/or rivers. At 10 parts per quadrillion the Earth's oceans would hold 15,000 tons of gold.[45] These figures are three orders of magnitude less than reported in the literature prior to 1988, indicating contamination problems with the earlier data.

A number of people have claimed to be able to economically recover gold from sea water, but so far they have all been either mistaken or crooks. A so-called reverend, Prescott Jernegan ran a gold-from-seawater swindle in the United States in the 1890s. A British fraudster ran the same scam in England in the early 1900s.[46] Fritz Haber (the German inventor of the Haber process) did research on the extraction of gold from sea water in an effort to help pay Germany's reparations following World War I.[47] Based on the published values of 2 to 64 ppb of gold in seawater a commercially successful extraction seemed possible. After analysis of 4,000 water samples yielding an average of 0.004 ppb it became clear that the extraction would not be possible and he stopped the project.[48] No commercially viable mechanism for performing gold extraction from sea water has yet been identified. Gold synthesis is not economically viable and is unlikely to become so in the foreseeable future.

Gallery of specimens of crystalline native gold

Production

Main articles: Gold prospecting, Gold mining, Gold extraction, and List of countries by gold production

Gold extraction is most economical in large, easily mined deposits. Ore grades as little as 0.5 mg/kg (0.5 parts per million, ppm) can be economical. Typical ore grades in open-pit mines are 1–5 mg/kg (1–5 ppm); ore grades in underground or hard rock mines are usually at least 3 mg/kg (3 ppm). Because ore grades of 30 mg/kg (30 ppm) are usually needed before gold is visible to the naked eye, in most gold mines the gold is invisible.

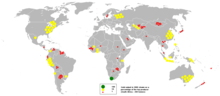

Since the 1880s, South Africa has been the source for a large proportion of the world's gold supply, with about 50% of all gold ever produced having come from South Africa. Production in 1970 accounted for 79% of the world supply, producing about 1,480 tonnes. 2008 production was 2,260 tonnes. In 2007China (with 276 tonnes) overtook South Africa as the world's largest gold producer, the first time since 1905 that South Africa has not been the largest.[49]

The city of Johannesburg located in South Africa was founded as a result of the Witwatersrand Gold Rush which resulted in the discovery of some of the largest gold deposits the world has ever seen. Gold fields located within the basin in the Free State and Gauteng provinces are extensive in strike and diprequiring some of the world's deepest mines, with the Savuka and TauTona mines being currently the world's deepest gold mine at 3,777 m. The Second Boer War of 1899–1901 between the British Empire and the Afrikaner Boers was at least partly over the rights of miners and possession of the gold wealth in South Africa.

Other major producers are the United States, Australia, Russia and Peru. Mines in South Dakota and Nevada supply two-thirds of gold used in the United States. In South America, the controversial project Pascua Lama aims at exploitation of rich fields in the high mountains of Atacama Desert, at the border between Chile and Argentina. Today about one-quarter of the world gold output is estimated to originate from artisanal or small scale mining.[50]

After initial production, gold is often subsequently refined industrially by the Wohlwill process which is based on electrolysis or by the Miller process, that is chlorination in the melt. The Wohlwill process results in higher purity, but is more complex and is only applied in small-scale installations.[51][52] Other methods of assaying and purifying smaller amounts of gold include parting and inquartation as well as cupellation, or refining methods based on the dissolution of gold in aqua regia.[53]

At the end of 2009, it was estimated that all the gold ever mined totaled 165,000 tonnes[1] This can be represented by a cube with an edge length of about 20.28 meters. At $1,600 per ounce, 165,000 tons of gold would have a value of $8.8 trillion.

The average gold mining and extraction costs were about US$317/oz in 2007, but these can vary widely depending on mining type and ore quality; global mine production amounted to 2,471.1 tonnes.[54]

Most of the gold used in manufactured goods, jewelry, and works of art is eventually recovered and recycled. Some gold used in spacecraft and electronic equipment cannot be profitably recovered, but it is generally used in these applications in the form of extremely thin layers or extremely fine wires so that the total quantity used (and lost) is small compared to the total amount of gold produced and stockpiled. Thus there is little true consumption of new gold in the economic sense; the stock of gold remains essentially constant (at least in the modern world) while ownership shifts from one party to another.[55] One estimate is that 85% of all the gold ever mined is still available in the world's easily recoverable stocks, with 15% having been lost, or used in non-recyclable industrial uses.[56]

Consumption

The consumption of gold produced in the world is about 50% in jewelry, 40% in investments, and 10% in industry.

India is the world's largest single consumer of gold, as Indians buy about 25% of the world's gold,[57] purchasing approximately 800 tonnes of gold every year, mostly for jewelry. India is also the largest importer of gold; in 2008, India imported around 400 tonnes of gold.[58]

Country | 2010 | 2009 | % Change |

|---|---|---|---|

| 745.70 | 442.37 | +69 | |

| 428.00 | 376.96 | +14 | |

| 128.61 | 150.28 | -14 | |

| 74.07 | 75.16 | -1 | |

| 72.95 | 77.75 | -6 | |

| 67.50 | 60.12 | +12 | |

| 63.37 | 67.60 | -6 | |

| 53.43 | 56.68 | -6 | |

| 32.75 | 41.00 | -20 | |

| 27.35 | 31.75 | -14 | |

| Other Gulf Countries | 21.97 | 24.10 | -10 |

| 18.50 | 21.85 | -15 | |

| 15.87 | 18.83 | -16 | |

| 14.36 | 15.08 | -5 | |

| 6.28 | 7.33 | -14 | |

| Total | 1805.60 | 1508.70 | +20 |

| Other Countries | 254.0 | 251.6 | +1 |

| World Total | 2059.6 | 1760.3 | +17 |

Chemistry

Although gold is a noble metal, it forms many and diverse compounds. The oxidation state of gold in its compounds ranges from −1 to +5, but Au(I) and Au(III) dominate its chemistry. Au(I), referred to as the aurous ion, is the most common oxidation state with soft ligands such as thioethers, thiolates, and tertiaryphosphines. Au(I) compounds are typically linear. A good example is Au(CN)2−, which is the soluble form of gold encountered in mining. Curiously, aurous complexes of water are rare. The binary gold halides, such as AuCl, form zigzag polymeric chains, again featuring linear coordination at Au. Most drugs based on gold are Au(I) derivatives.[60]

Au(III) (auric) is a common oxidation state, and is illustrated by gold(III) chloride, Au2Cl6. The gold atom centers in Au(III) complexes, like other d8compounds, are typically square planar, with chemical bonds that have both covalent and ionic character.

Aqua regia, a 1:3 mixture of nitric acid and hydrochloric acid, dissolves gold. Nitric acid oxidizes the metal to +3 ions, but only in minute amounts, typically undetectable in the pure acid because of the chemical equilibrium of the reaction. However, the ions are removed from the equilibrium by hydrochloric acid, forming AuCl4− ions, or chloroauric acid, thereby enabling further oxidation.

Some free halogens react with gold.[61] Gold also reacts in alkaline solutions of potassium cyanide. With mercury, it forms an amalgam.

Less common oxidation states

Less common oxidation states of gold include −1, +2, and +5.

The −1 oxidation state occurs in compounds containing the Au− anion, called aurides. Caesium auride (CsAu), for example, crystallizes in the caesium chloride motif.[62] Other aurides include those ofRb+, K+, and tetramethylammonium (CH3)4N+.[63]

Gold(II) compounds are usually diamagnetic with Au–Au bonds such as [Au(CH2)2P(C6H5)2]2Cl2. The evaporation of a solution of Au(OH)3 in concentrated H2SO4 produces red crystals of gold(II) sulfate, AuSO4. Originally thought to be a mixed-valence compound, it has been shown to contain Au4+

2 cations.[64][65] A noteworthy, legitimate gold(II) complex is the tetraxenonogold(II) cation, which contains xenon as a ligand, found in [AuXe4](Sb2F11)2.[66]

2 cations.[64][65] A noteworthy, legitimate gold(II) complex is the tetraxenonogold(II) cation, which contains xenon as a ligand, found in [AuXe4](Sb2F11)2.[66]

Gold pentafluoride and its derivative anion, AuF−

6, is the sole example of gold(V), the highest verified oxidation state.[67]

6, is the sole example of gold(V), the highest verified oxidation state.[67]

Some gold compounds exhibit aurophilic bonding, which describes the tendency of gold ions to interact at distances that are too long to be a conventional Au–Au bond but shorter that van der Waals bonding. The interaction is estimated to be comparable in strength to that of a hydrogen bond.

Mixed valence compounds

Well-defined cluster compounds are numerous.[63] In such cases, gold has a fractional oxidation state. A representative example is the octahedral species {Au(P(C6H5)3)}62+. Gold chalcogenides, such as gold sulfide, feature equal amounts of Au(I) and Au(III).

Toxicity

Pure metallic (elemental) gold is non-toxic and non-irritating when ingested[68] and is sometimes used as a food decoration in the form of gold leaf. Metallic gold is also a component of the alcoholic drinks Goldschläger, Gold Strike, and Goldwasser. Metallic gold is approved as a food additive in the EU (E175 in the Codex Alimentarius). Although gold ion is toxic, the acceptance of metallic gold as a food additive is due to its relative chemical inertness, and resistance to being corroded or transformed into soluble salts (gold compounds) by any known chemical process which would be encountered in the human body.

Soluble compounds (gold salts) such as gold chloride are toxic to the liver and kidneys. Common cyanide salts of gold such as potassium gold cyanide, used in gold electroplating, are toxic by virtue of both their cyanide and gold content. There are rare cases of lethal gold poisoning from potassium gold cyanide.[69][70] Gold toxicity can be ameliorated with chelation therapy with an agent such asDimercaprol.

Gold metal was voted Allergen of the Year in 2001 by the American Contact Dermatitis Society. Gold contact allergies affect mostly women.[71] Despite this, gold is a relatively non-potent contact allergen, in comparison with metals like nickel.[72]

Price

Like other precious metals, gold is measured by troy weight and by grams. When it is alloyed with other metals the term carat or karat is used to indicate the purity of gold present, with 24 carats being pure gold and lower ratings proportionally less. The purity of a gold bar or coin can also be expressed as a decimal figure ranging from 0 to 1, known as the millesimal fineness, such as 0.995 being very pure.

The price of gold is determined through trading in the gold and derivatives markets, but a procedure known as the Gold Fixing in London, originating in September 1919, provides a daily benchmark price to the industry. The afternoon fixing was introduced in 1968 to provide a price when US markets are open.

Historically gold coinage was widely used as currency; when paper money was introduced, it typically was a receipt redeemable for gold coin or bullion. In a monetary system known as the gold standard, a certain weight of gold was given the name of a unit of currency. For a long period, the United States government set the value of the US dollar so that one troy ounce was equal to $20.67 ($664.56/kg), but in 1934 the dollar was devalued to $35.00 per troy ounce ($1125.27/kg). By 1961, it was becoming hard to maintain this price, and a pool of US and European banks agreed to manipulate the market to prevent further currency devaluation against increased gold demand.

On March 17, 1968, economic circumstances caused the collapse of the gold pool, and a two-tiered pricing scheme was established whereby gold was still used to settle international accounts at the old $35.00 per troy ounce ($1.13/g) but the price of gold on the private market was allowed to fluctuate; this two-tiered pricing system was abandoned in 1975 when the price of gold was left to find its free-market level. Central banks still hold historical gold reserves as a store of value although the level has generally been declining. The largest gold depository in the world is that of the U.S. Federal Reserve Bank in New York, which holds about 3%[73] of the gold ever mined, as does the similarly laden U.S. Bullion Depository at Fort Knox. In 2005 the World Gold Council estimated total global gold supply to be 3,859 tonnes and demand to be 3,754 tonnes, giving a surplus of 105 tonnes.[74]

Since 1968 the price of gold has ranged widely, from a high of $850/oz ($27,300/kg) on January 21, 1980, to a low of $252.90/oz ($8,131/kg) on June 21, 1999 (London Gold Fixing).[75] The period from 1999 to 2001 marked the "Brown Bottom" after a 20-year bear market.[76] Prices increased rapidly from 1991, but the 1980 high was not exceeded until January 3, 2008 when a new maximum of $865.35 per troy ounce was set.[77] Another record price was set on March 17, 2008 at $1023.50/oz ($32,900/kg).[77] In late 2009, gold markets experienced renewed momentum upwards due to increased demand and a weakening US dollar. On December 2, 2009, Gold passed the important barrier of US$1200 per ounce to close at $1215.[78] Gold further rallied hitting new highs in May 2010 after the European Union debt crisis prompted further purchase of gold as a safe asset.[79][80] On March 1, 2011, gold hit a new all-time high of $1432.57, based on investor concerns regarding ongoing unrest in North Africa as well as in the Middle East.[81]

Since April 2001 the gold price has more than quintupled in value against the US dollar, hitting a new all-time high of $1,826 on August 18, 2011,[82] prompting speculation that this long secular bear market has ended and a bull market has returned.[83]

Symbolism

Gold has been highly valued in many societies throughout the ages. In keeping with this it has often had a strongly positive symbolic meaning closely connected to the values held in the highest esteem in the society in question. Gold may symbolize power, strength, wealth, warmth, happiness, love, hope, optimism, intelligence, justice, balance, perfection, summer, harvest and the sun.

Great human achievements are frequently rewarded with gold, in the form of gold medals, golden trophies and other decorations. Winners of athletic events and other graded competitions are usually awarded a gold medal (e.g., the Olympic Games). Many awards such as the Nobel Prize are made from gold as well. Other award statues and prizes are depicted in gold or are gold plated (such as the Academy Awards, the Golden Globe Awards, the Emmy Awards, the Palme d'Or, and the British Academy Film Awards).

Aristotle in his ethics used gold symbolism when referring to what is now commonly known as the "golden mean". Similarly, gold is associated with perfect or divine principles, such as in the case of the "golden ratio".

Gold represents great value. Respected people are treated with the most valued rule, the "golden rule". A company may give its most valued customers "gold cards" or make them "gold members". We value moments of peace and therefore we say: "silence is golden". In Greek mythology there was the "golden fleece".

Gold is further associated with the wisdom of aging and fruition. The fiftieth wedding anniversary is golden. Our precious latter years are sometimes considered "golden years". The height of a civilization is referred to as a "golden age".

In Christianity gold has sometimes been associated with the extremities of utmost evil and the greatest sanctity. In the Book of Exodus, the Golden Calf is a symbol of idolatry. In the Book of Genesis,Abraham was said to be rich in gold and silver, and Moses was instructed to cover the Mercy Seat of the Ark of the Covenant with pure gold. In Christian art the halos of Christ, Mary and the Christiansaints are golden.

Medieval kings were inaugurated under the signs of sacred oil and a golden crown, the latter symbolizing the eternal shining light of heaven and thus a Christian king's divinely inspired authority.Wedding rings have long been made of gold. It is long lasting and unaffected by the passage of time and may aid in the ring symbolism of eternal vows before God and/or the sun and moon and the perfection the marriage signifies. In Orthodox Christianity, the wedded couple is adorned with a golden crown during the ceremony, an amalgamation of symbolic rites.

In popular culture gold holds many connotations but is most generally connected to terms such as good or great, such as in the phrases: "has a heart of gold", "that's golden!", "golden moment", "then you're golden!" and "golden boy". Gold also still holds its place as a symbol of wealth and through that, in many societies, success.

0 comments:

Post a Comment